TBS/PP: When Bad Things Happen To Good Businesses… Buy

The Market Selloff Signals Both Caution And Opportunity

This is Porter & Co.’s The Big Secret on Wall Street, our flagship publication that we publish every Thursday at 4 pm ET. Once a month, we provide to our paid-up subscribers a full report on a stock recommendation, and also a monthly extensive review of the current portfolio, as we share below… At the end of this week’s issue, paid-up subscribers can find our Top 3 “Best Buys,” three current portfolio picks that are at an attractive buy price. You can go here to see the full portfolio of The Big Secret.

In our recent three-part series of the Daily Journal, ending yesterday, we made the case for a potential 50% decline in the U.S. stock market (measured by the S&P 500). We explained how the greatest bull market in 50 years fueled a record consumption boom among the top 10% of U.S. households, while the bottom 90% have seen their purchasing power eviscerated by inflation.

We also detailed the growing signs that members of this top 10% cohort propping up the U.S. economy are now tightening their belts. And we laid out a scenario in which the pullback in consumption among the wealthy could be amplified by the recent losses in the U.S. stock market. We also explained how this could lead to a self-reinforcing downward spiral of lower consumer spending, lower corporate earnings, and falling stock prices that would create more pressure on consumer spending, and so on.

Plus, the U.S. economy also faces the dual-pronged threats of a global trade war and a reduction in government spending, which we detailed in our previous portfolio update. Against a backdrop of near-record-high valuations that have priced U.S. stocks for perfection, we continue to urge that investors treat today’s market with extreme caution.

Specifically, we urge that investors pay close attention to individual position sizing and the overall exposure to stocks within a portfolio, and to follow trailing stops to limit downside. We also recommend holding a comfortable cash position, as well as defensive assets like gold, which has gained 15% so far this year and acted as a stabilizing force against declining stock prices within a diversified portfolio.

But despite the risks in the overall U.S. stock market, there are many bargains emerging under the surface of the broad market index.

In this issue, we’re providing updates for six stocks in The Big Secret On Wall Street portfolio that each trade at highly attractive valuations. A few of these stocks have suffered their own brutal bear market, down 50% or more from their previous highs, and some of which trade at their lowest valuation levels in the last decade.

These businesses are facing either temporary operational challenges, cyclical downturns in their industries, or investor pessimism that’s sent their share prices down even while earnings continue to grow. In each case, we believe the market has pushed the prices of these shares down to virtually no-risk buy levels. Importantly, this doesn’t mean we believe their share prices can’t drop further in the near term. But for investors with a long-term time horizon, we believe that owning these stocks over the next three years should come with very little downside risk, while offering a high likelihood of market-beating returns.

Reiterating Our Best Buy Recommendation On Nike

Nike (NYSE: NKE) shares dropped by 6% following its March 20 earnings report for the company’s fiscal Q3 reporting period (the three months ending in February). Shares initially rallied in after-hours trading following the release of the report, when the company exceeded the low-bar Wall Street analysts set for the current quarter. This included a 9% year-on-year (“YOY”) drop in revenue to $11.3 billion (versus $11.1 billion expected) and a 30% drop in earnings per share (“EPS”) to $0.54 (versus $0.26 expected).

However, the gains turned to losses during the conference call with analysts later that evening, when Nike’s management warned that its financial results would get worse before getting better. Specifically, management expects Nike’s rate of revenue decline to increase from 9% in Q3 to the “mid-teens range” in Q4. Management also expects profit margins to drop by 4 to 5 percentage points YOY in Q4, versus the 3.3 percentage point decline in Q3.

Nike’s declining sales and margin outlook are the byproduct of the turnaround plan that Elliott Hill laid out during his first quarterly conference call as CEO on December 19. As we described in our previous update, Hill’s plan involves a deliberate choice to take near-term pain in Nike’s financial results in order to set the stage for its long-term success. One key component of this strategy involves clearing out Nike’s inventory of stale merchandise, so that the company can introduce new products at premium prices. In the short term, selling old products at discounted prices is creating a drag on both revenue and profit margins.

Meanwhile, Nike is investing aggressively into developing innovative new products. But we expect it will take several quarters before these investments translate into enough new products to meaningfully boost Nike’s revenue. In the meantime, the additional spending on new product development will eat into the company’s profit margins.

In addition to developing its own new products, Nike is also forging new partnerships, including a recently announced collaboration with Kim Kardashian’s Skims shapewear company to launch the NikeSkims brand of athletic apparel. Skims was co-founded by Kardashian in 2019, and in just six years, the business has grown from nothing to a $4 billion valuation. Skims is one of several billion-dollar consumer-product brands launched by the Kardashian-Jenner family. In each case, the success of these brands has been fueled by the family’s massive media presence that includes a combined 1.2 billion social media followers. The new NikeSkims collaboration holds a lot of promise in combining Kardashian’s media presence with the global brand and distribution power of Nike.

Nike plans to launch the first NikeSkims products in North America this spring, followed by a global rollout over the next several quarters.

Meanwhile, Nike is also increasing its investments into new marketing and advertising campaigns. The company aired its first Super Bowl ad in 27 years in February, and is also aggressively pursuing endorsement partnerships with the next generation of up-and-coming athletes. This includes its recent sponsorship deals for the NCAA basketball tournament – which concludes over the next two weekends – where Nike secured sponsorships with virtually all of the number-one and number-two seed teams, leaving the competition fighting for scraps among the lower-tier teams:

And therein lies the key to Nike’s enduring competitive advantage as the world’s largest and most profitable footwear and athletic apparel maker. As we explained in our recommendation in April 2024, Nike simply has the biggest war chest to strike endorsement deals with the world’s top athletes to adorn its logo and promote its brand to billions of sports fans around the world. And despite its recent financial struggles, Nike still out-earns its next closest rivals by a wide margin, with $6 billion in net income last year versus Adidas at $890 million and Deckers Outdoor (DECK) at $950 million.

Thus, we believe that as long as the company can rejuvenate its product line and continue investing in the next generation of athletes and celebrity influencers to promote its brand, it will enjoy many decades of consumer demand.

In the meantime, Wall Street’s myopic focus on short-term quarterly results has created a tremendous buying opportunity in shares of Nike. Given that the company’s turnaround plan is depressing its short-term earnings, we believe the price-to-sales ratio (P/S) is the best valuation metric for Nike right now. And with a P/S ratio of just 2x, Nike trades at its lowest valuation level of the last decade, and a 44% discount to its 10-year average valuation of 3.6x price to sales:

Nothing in the latest financial results changes our view that the company has all of the pieces in place to achieve these goals. And we continue to see an upside case for Nike to earn over $6 per share by 2028, which should push its share price up to $200, more than 3x the $66 where it now trades.

We suggest using the recent share price decline to add to an existing position, or to initiate a new position if you don’t already own shares. Nike is one of our top three “Best Buys” in the portfolio, and our advice remains the same:

Coal Bear Market Weighs On Peabody And Core Natural Resources

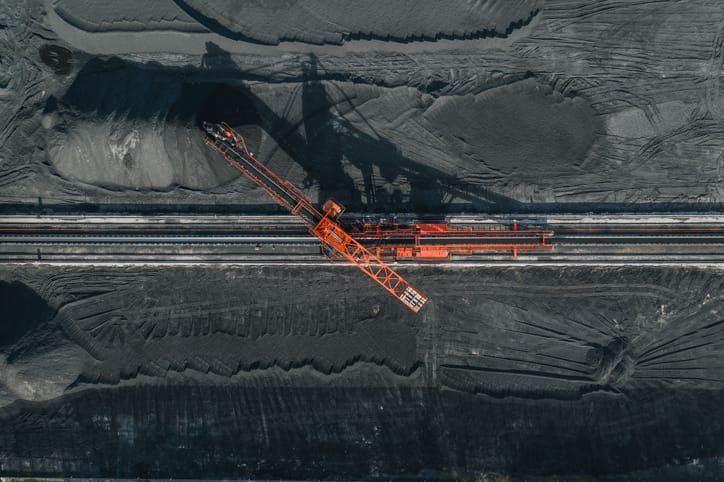

Shares of the two coal companies in The Big Secret portfolio, Core Natural Resources (NYSE: CNR) and Peabody Energy (NYSE: BTU), have each dropped by over 30% year to date, as falling coal prices have sent the entire sector into a bear market. Prices for metallurgical coal (“met coal”), the kind used in steel-making, have dropped 70% from $600 per ton in early 2022 to around $175 today:

Following a temporary increase in met-coal prices due to supply disruptions stemming from the Russian invasion of Ukraine in early 2022, the market has slumped in recent years due to a weak economy in China, resulting in lower demand. China is the world’s largest met-coal consumer, making up 60% of global demand, and met-coal prices have become collateral damage from the bursting of the country’s real estate bubble. Over the past three years, China’s real-estate market has faced falling prices and depressed sales, a trend that accelerated last year.

Sluggish construction activity in China has created a glut of stockpiled steel, leading to a rare decline in the nation’s steel production last year. As a result, China’s consumption of met coal has plunged. However, there’s reason for optimism ahead.

Starting in September 2024, the Chinese government began implementing a series of aggressive fiscal and monetary stimulus programs aimed at jumpstarting its economy, with a particular emphasis on reviving the real estate market. This included a 50-basis-point reduction in mortgage rates, and lowering the required down-payment level to 15% of the home price, from 25%. By December, home prices had stopped declining for the first time in 18 months, followed by an increase in prices in January. Meanwhile, Chinese industrial activity is beginning to come back, with the country’s stock market having gained an impressive 19% year-to-date. Analysts from Goldman Sachs and financial research firm S&P Global are calling for a stabilization in Chinese real estate prices this year.

So far, met-coal prices have remained low as the country continues working through its elevated steel inventory. However, if the Chinese economy continues improving, it’s only a matter of time before steel producers begin increasing production. This, in turn, should provide an uplift in met coal demand as the year progresses.

Meanwhile, thermal-coal prices (the kind used for electricity generation) have also dropped to multi-year lows in recent months. Like met-coal prices, thermal-coal prices set new highs following the supply disruptions from the war in Ukraine. Prices then dropped as supplies returned to previous levels. Then, unseasonably warm winter weather in the U.S. and Europe this year contributed to an oversupply, pushing prices lower over the past several months. As a result, thermal-coal prices have dropped from over $200 per ton in early 2022 to below $100 today:

Here again, there’s reason to believe thermal-coal prices will move higher in the years ahead, especially in the U.S. This will come from the ravenous demand for electricity needed to fuel the data centers underpinning the artificial intelligence (“AI”) revolution, as we’ve discussed previously.

Analysts currently forecast that U.S. electricity demand will increase by 5% per year through 2030. That increase is a game changer for the U.S. power sector, where electricity consumption has been flat for the last two decades. And because it takes years to bring new power plants online, suppliers will turn to reliable old coal plants to help with electricity generation.

Last week, President Donald Trump announced that he would authorize the opening of “hundreds” of new coal-fired power plants:

Even before the pro-coal Trump administration took office, the growing demands on the U.S. power grid was giving new life to coal-fired power generation, which has dropped from supplying 40% of U.S. electricity in 2014 to 16% in 2023.

Before the explosion in electricity demand from AI data centers, as recently as 2023 an estimated 54 gigawatts of coal-fired power generation was slated to be retired by 2030. But in May 2024, those projections were cut by 40%, according to research from S&P Global:

Even a slowdown in the rate of coal-plant retirements will deliver a boost for the few remaining U.S. coal companies, which have learned to thrive in an environment of declining demand. Plus, if Trump gets his way, America could begin building new coal plants instead of shutting down existing ones. It’s one of many reasons to be bullish on the coal sector today.

But the biggest reason for optimism in the coal sector is that these companies have been beaten down, pushing their prices into deep value territory.

This includes Core Natural Resources (“CNR”), the newly formed entity from the merger of CONSOL Energy and Arch Resources, which closed on January 14. CNR announced its 2024 financial results on February 20, reporting $670 million in EBITDA (earnings before interest, tax, depreciation, and amortization) for the year, down 35% from 2023 due to lower coal prices.

However, thanks to the added production the company acquired from Arch Resources, analysts are forecasting CNR will generate $872 million in EBITDA this year followed by a record $1.2 billion in 2026.

CNR trades at a market capitalization of just under $4 billion. Its balance sheet includes over $200 million in net cash, giving the company an enterprise value (“EV”) of $3.7 billion. Thus, CNR trades at an EV/EBITDA multiple of 4.3x based on 2025 earnings estimates, and 3.0x based on 2026 projections.

Normally, commodity stocks trade around 6x to 8x earnings. But CNR shares now trade cheap even based on the depressed earnings outlook during the current bear market in coal prices. Thus, when prices inevitably rebound, the company could benefit from the one-two combination of rising earnings and a higher valuation multiple.

In the meantime, CNR’s management is capitalizing on the company’s depressed valuation by committing to return 75% of free cash flow to shareholders, mostly through share buybacks.

This includes a $1 billion share buyback authorization announced in the February 20 earnings report, equal to 25% of CNR’s current market cap.

Thus CNR offers a clean balance sheet, a discounted valuation, and a clear pathway toward higher earnings from the added production of its recent merger (plus additional upside from higher coal prices). In the meantime, investors will benefit from a falling share count as management capitalizes on the depressed share price through stock repurchases.

For all of these reasons, at $77 per share, CNR remains one of our favorite coal stocks in the market, and our advice remains the same:

Peabody Energy reported its Q4 and full-year 2024 financial results on February 6. Like CNR, lower coal prices caused a 40% YOY decline in Peabody’s EBITDA from 2023, to $855 million in 2024.

And also like CNR, Peabody is taking advantage of the depressed coal-price environment by acquiring assets at bargain prices. But instead of merging with another U.S. company, Peabody announced on November 25 that it plans to acquire the Australian met-coal assets from Anglo American. We previously analyzed the transaction (expected to close sometime in Q2) in a December 12 portfolio update, and explained why we believed the company is getting their hands on great assets and on excellent terms – including a limit on Peabody’s financial obligations unless coal prices rise, and unless certain future production metrics are achieved.

But lower coal prices are not helping its financial situation at the moment. Peabody’s management used a forecast for met-coal prices ranging from $235 to $255 per ton in its financial projections for the cash flows it expected from the Australian assets. When the deal was announced, Australian met-coal prices were around $205 per ton. Since then, prices have dropped to just below $175 per ton.

Making matters worse, the thermal-coal prices that make up the majority of Peabody’s current cash flows have also dropped. While we’re optimistic that prices will eventually recover – both for thermal and met coal – the market has punished shares of Peabody.

Even with the favorable deal terms that stretch out a portion of the payments for the Anglo American assets over several years, Peabody will still need to pay an upfront $2.05 billion upon the closing of the deal. The company has secured a $2.07 billion bridge financing loan to complete the deal, and it expects to replace that loan with permanent financing before the deal closes.

Given that Peabody’s stock price has declined by 50% in the last six months, deflating its total market cap to just $1.7 billion, equity financing would be highly dilutive and is likely not an option. That means Peabody will likely turn to the debt market, transforming its previously debt-free balance sheet (it had $300 million in net cash before the deal) to one with approximately $1.7 billion in net debt. It’s not ideal but it is manageable. Peabody aims to keep its leverage ratio at 1.5x, which appears achievable based on its EBITDA of $651 million last year, and current analyst projections of $742 million this year and $1.2 billion next year.

But the bottom line is that Peabody has made an aggressive bet with its purchase of Anglo American. The deal could look brilliant in hindsight if coal prices rise and the company avoids any serious operational setbacks in taking over the mining operations, but it also raises Peabody’s risk profile in the meantime. And the added debt will prevent Peabody from returning any capital to shareholders for the foreseeable future, which likely caused many existing investors to sell shares following the deal announcement.

But at its current enterprise value of $1.6 billion, at $14 per share, Peabody trades at less than 2x last year’s EBITDA. And that leaves a lot of upside on the table for investors if coal prices rise and the Anglo assets perform as expected.

As a result, we continue to recommend investors buy shares of Peabody.

Competition Fears Send Novo Nordisk Shares Into The Bargain Bin

Shares of pharmaceutical giant Novo Nordisk (NYSE: NVO) have dropped 50% in the last nine months, to around $70. The decline has primarily been driven by concerns about competition in the booming GLP-1 (glucagon-like peptide-1) weight-loss and diabetes-drug market, which make up the majority of Novo Nordisk’s sales.

We believe these fears are overblown, creating a rare opportunity to buy NVO shares at a significant discount.

The primary competitive threat facing Novo Nordisk is the success of Eli Lilly’s tirzepatide-based drugs, including Mounjaro for diabetes and Zepbound for weight loss. Unlike Novo’s semaglutide-based GLP-1 drugs, which only activate the body’s GLP-1 receptor, tirzepatide activates both the GLP-1 and another receptor known as GIP (glucose-dependent insulinotropic polypeptide receptor).

Tirzepatide’s dual-acting mechanism has been shown to increase appetite suppression more effectively than Novo’s semaglutide-based drugs, with clinical trials showing an average weight loss of 20.2% of body weight, compared with 13.7% for semaglutide. Likewise, for diabetes patients, tirzepatide has been shown to reduce A1C levels by 2.0% to 2.3% versus 1.9% for semaglutide.

But these better clinical results doesn’t automatically mean patients and doctors around the world will suddenly favor tirzepatide over semaglutide-based drugs. Factors like brand power and established sales channels with doctors and pharmacies also play a big role in deciding which drugs win in the marketplace. And in this respect, Novo Nordisk has a first-mover advantage over Eli Lilly, starting with the 2017 launch of Ozempic followed by Wegovy in mid 2021. Conversely, Eli Lilly didn’t launch Monjauro (the Ozempic competitor) until mid 2022, followed by Zepbound (the Wegovy competitor) at the end of 2023.

This means that Novo Nordisk had a multi-year head start in establishing a trusted brand among consumers, plus plenty of time to develop a robust sales channel with doctors around the globe. So even though some portion of consumers and doctors will likely favor Eli Lilly’s drugs, Novo Nordisk’s GLP-1 sales have continued growing at impressive rates.

Consider that Eli Lilly’s Mounjaro sales increased by 124% last year to reach $11.5 billion, and Zepbound grew from almost $176 million in sales in 2023 to $4.9 billion. But even with this increase in sales from competing drugs, Novo still reported a healthy 26% increase in Ozempic sales to reach $18 billion in 2024. Meanwhile, Wegovy sales increased by an impressive 86% last year to reach $8.7 billion.

Zooming out, Novo Nordisk’s market share across its three key categories of GLP-1s, diabetes drugs, and insulin has remained remarkably steady over the past few years:

The market for diabetes and weight-loss drugs is growing fast enough – it’s expected to reach over $100 billion by 2030 – that both Eli and Novo can thrive for years to come. In fact, both routinely face challenges in ramping up manufacturing capacity fast enough to meet demand. We see no reason why Novo Nordisk can’t continue to increase sales and earnings at double-digit rates for the foreseeable future.

Despite the headline fears of increased competition, Novo Nordisk grew its sales by a solid 26% last year (excluding the impact of foreign exchange fluctuations). Meanwhile, EPS increased by 29% from $3.50. Looking ahead, analysts currently expect Novo’s earnings to increase by an average of 15% per year over the next five years to reach $7 by 2029:

And with the share price down by 50%, to $70, from its former highs, Novo Nordisk currently trades at just under 20x this year’s expected EPS of $4 – the lowest valuation of the last five years, and a 25% discount to its 10-year average one-year forward P/E ratio:

As a result of Novo’s discounted valuation, we are changing our recommendation from “hold” to “buy,” and recommend investors buy up to $100 per share.

Venture Global Earnings Drop Creates Buying Opportunity

A buying opportunity emerged in shares of liquefied natural gas (“LNG”) exporter Venture Global (NYSE: VG) after a 30% drop from $15 – when we put the company on our Watchlist in our February 13 issue – to just under $11 last week, when we alerted subscribers to our updated recommendation to buy shares on March 17.

The cause of the recent decline in Venture Global’s share price was a disappointing Q4 earnings report on March 6. The company reported lower LNG prices in Q4, combined with fewer than expected LNG shipments, which caused revenue to come at $1.52 billion in Q4, or 21% below analyst estimates of $1.92 billion. Meanwhile, higher operating costs caused earnings per share to disappoint at $0.33, versus estimates of $0.76.

The company also increased the expected costs to complete its Plaquemines LNG expansion project by $2 billion, citing cost inflation. Plus, management provided earnings guidance for 2025 that called for EBITDA of $6.8 to $7.4 billion, 21% below analyst estimates of $9.1 billion before the earnings report.

Venture Global’s share price dropped by 36% to $9 following the report, but have since rebounded to $12 as of Wednesday’s close. But nothing we saw in the Q4 earnings report changed our long-term bullish thesis for the business. We believe the main culprit for the disappointing results is that Wall Street analysts had little information to go on in determining their quarterly estimates for the company’s first earnings report as a public company, and thus the analysts set their expectations too high.

But now, expectations, and its valuation, have been reset. At $12 per share, Venture Global trades at a $29 billion market cap, and an enterprise value (“EV”) of $59 billion. Relative to management’s expected EBITDA of $7.1 billion (at the midpoint of guidance) this year, the business trades at an EV/EBITDA of less than 8x. That’s a more than 30% discount to its top competitor, Cheniere Energy (NYSE: LNG), which trades at 11.6x EV to EBITDA.

Despite VG’s lower valuation, the company is on track to outpace Cheniere’s growth over the next few years. And all signs indicate Venture Global’s growth trajectory remains on track, including two approvals it recently received from the Federal Energy Regulatory Commission (“FERC”), including:

- On February 7, FERC gave Venture Global the green light to proceed with its environmental impact for the CP2 LNG project – its third and largest LNG project slated for initial shipments in 2028.

- On February 20, FERC approved the company’s plan to expand capacity at its Plaquemines Project, its second LNG facility, by 13% to 27.2 million tons per year.

With the shares down by over 50% from its initial public offering price of $25 in January, and trading at a steep discount to its top competitor, we believe Venture Global offers a compelling value.

We’re not the only ones seeing value in shares of Venture Global. Earlier this month, three company insiders made significant purchases of the stock, including co-founders Michael Sable and Robert Pender, and board member Jimmy Staton. Together, these three insiders bought 2.4 million shares for a total of $24 million, at prices ranging from $8.95 to $10.71.

While we’re bullish about Venture Global’s future prospects, we reiterate our view that the stock comes with significant risk, as we detailed in our February recommendation (and as evidenced by the recent sharp share price decline). Thus, we are assigning this recommendation our highest risk rating level of 5, and urge investors to size their positions appropriately.

PayPal’s Transformation Is In Full Swing

Shares of PayPal (Nasdaq: PYPL) have dropped 19% year to date, despite its solid earnings and cash flow trajectory. We think the downturn represents a good opportunity to buy shares of this leading digital-payments platform.

PayPal, which we added to The Big Secret portfolio in July 2023, reported its Q4 and full year financial results on February 4. The company generated $6.6 billion in free cash flow in 2024, up 43% over 2023, and delivered $4.95 in EPS, up 21% for the year. Additionally, Q4 EPS of $1.11 surpassed analyst estimates by 5%. PayPal now trades at 15.5x last year’s earnings – its lowest valuation on record. The company plans to repurchase $6 billion (or 8%) of shares this year.

The company continues to innovate as well. At its 2025 Investor Day on February 25, management unveiled a new strategy to unify its merchant and shopper experiences into a single platform – a move expected to accelerate earnings growth, leading to double-digit EPS growth by 2027.

It’s been 18 months since Alex Chriss took over as CEO, ushering in an entirely new executive team (including the former head of Uber’s advertising business) to propel PayPal’s turnaround. Under this new leadership, PayPal launched Fastlane – an innovative checkout product designed to boost merchant conversions and re-engage both new and inactive customers.

Initial data shows Fastlane is broadening PayPal’s user base – with more than 170 million U.S. accounts eligible to use the platform. About 25% of those Fastlane users have never had a PayPal account before, while more than half of users have a PayPal account but haven’t been active in the last 12 months. That means that 75% of Fastlane consumers are new or previously inactive PayPal users.

As PayPal launches innovative products like Fastlane that attract new consumers into its ecosystem, PayPal can upsell and cross sell them with higher value products through Venmo, so that they spend more across PayPal’s merchants. With over 430 million active consumer and merchant accounts, PayPal has tremendous scale and a global presence in 200+ markets.

Despite this mostly positive news, other parts of the business underperformed and will likely remain sluggish for the remainder of the year, causing Wall Street investors to sell shares.

Specifically, growth in PayPal’s legacy business segments fell to 2% compared to 11% growth the year prior. PayPal is improving the value proposition of these businesses in a way that gives merchants the full suite of PayPal’s features to drive higher conversions, like Fastlane. By improving the value proposition, PayPal will eventually generate higher margins and drive profitable growth.

At around $70 per share, and under our $75 buy-up-to price, the recent decline presents a compelling opportunity to add to an existing position or initiate a new one. With a rejuvenated leadership team, strategic initiatives gaining traction, and a valuation at historic lows, PayPal offers significant upside over the next three to five years.

New to The Big Secret Portfolio? Start With Our Top 3 “Best Buys” Today

Our goal at Porter & Co. is to bring you world-class investment research, focused on “inevitable” businesses that you can buy and hold forever. This is the surest and safest path to building permanent wealth.

While we don’t believe in timing the market, we do keep a constant eye out for bargains. In each edition of The Big Secret, we highlight three current portfolio picks that are at an attractive buy point. We suggest you focus on these:

1. Nike (NYSE: NKE) is the world’s largest athletic apparel and shoe maker. The company rose to prominence by creating one of the most beloved global brands, and has grown revenue in 22 of the last 25 years. A series of operational and strategic missteps has put Nike on track to post a rare decline in sales in 2025. However, company veteran Elliot Hill has stepped in as CEO to turn the business around. We believe Hill has laid out a credible plan for Nike to recover toward new record highs in revenue by 2028, and also return the company to its historic profit margins. In this scenario, Nike should generate more than $6 in earnings per share by 2028, driving its share price toward $200, from around $66 where it currently trades. We recommend buying Nike up to $100 per share.

2. The Hershey Company (NYSE: HSY) is the owner of the iconic 130-year old chocolate brand consumed by millions of Americans each year. Hershey is the ultimate forever stock, with a long history of navigating every economic environment or market shock. Hershey is currently on track for its sharpest earnings decline in over two decades due to a severe cocoa shortage that has driven prices up to record highs, resulting in reduced margins for the company. But with global cocoa supplies on track to normalize this year, we expect the company will recover to new all-time highs in revenue and profits in the years ahead. With shares trading at just 17x last year’s earnings, Hershey is near its cheapest valuation of the last decade – a compelling bargain for one of the world’s greatest brands and the ultimate “forever stock.” Currently trading at $169 per share, it is well below our recommended buy-up-to price of $200.

3. Uber Technologies (NYSE: UBER) is the world’s largest mobility platform, completing over 30 million ride-hailing trips and deliveries each day. After years of losing billions of dollars building a network of over 160 million consumers and 8 million drivers, Uber has now achieved sufficient scale to produce mountains of free cash flow. The business generated $6 billion in free cash flow in 2024, nearly double the $3.3 billion it produced in 2023. Uber is projected to reach $8 billion in free cash flow this year, and to continue growing at a double-digit pace over the coming years. At a $148 billion market capitalization, the business trades cheap at just 21x free cash flow, or a nearly 40% discount to the S&P 500. Currently trading at $74 per share, it is still below our recommended buy-up-to price of $100.

We cannot offer individual investment advice… but we can recommend TradeStops. TradeStops offers a customized suite of tools that can help you determine how much of a stock to buy… when to sell… when to buy more… and how much of your portfolio to dedicate to each position. As you know, we can’t tell you how to handle your investments, but we can, and do, advise you to get TradeStops. Learn more here.

Mailbag

In The Big Secret On Wall Street mailbag, Porter answers letters from readers. He cannot offer individual investment advice, but can respond to general questions.

Please email us at mailbag@porterandcompanyresearch.com to have your questions answered. We’d love to hear from you!

Today’s letter comes from L.N., who writes:

I don’t know how to value Philip Morris, but I do know that it’s gone from $90 to $150 in a relatively short amount of time. At some level, it could become overvalued relative to the underlying fundamentals.

I would love it if you could write about what happens when our “good companies at fair prices” become great companies at “just too expensive.”

Specifically, what happens if a stock does seem to have gone too far too soon (relative to what’s going on behind the scenes)? I would love to know whether you recommend trimming, or that your conviction is lower (so folks can read into that as they wish). And to be more specific, using Philip Morris as an example.”

Porter’s comment: Great question.

Some investors with advanced math degrees would tell you there’s a formula.

I prefer simply to use common sense.

Take Costco Wholesale (COST) — definitely a great business.

But, measured by its enterprise value (common stock plus net debt), it is currently valued at almost $500 million per store.

Simple question: does that make sense?

Well, maybe. If you bought 25 years ago… and as a result… your original capital is now compounding at 18% a year… just from dividends! Why would you sell?

My answer to your question is: it all just depends.

It depends on how capital efficient the business is.

It depends on the growth rate.

It depends on when you bought, and the tax consequences of selling.

Much of these considerations go well beyond the scope of our advisory because it depends on your own circumstances.

But, in general, I’ve got one rule.

Never… ever… sell a great business.

What’s a great business?

Tell me who has made more money than Philip Morris International (NYSE: PM) in the history of capitalism.

Or American Express (AXP).

Or Coke (KO).

Don’t sell great businesses.

But what if they’re trading at 50x earnings? Well… it just depends.

Porter & Co.

Stevenson, MD